Shop tax forms

(227 items found)

Sort by:

Best match

Adams 2023 1099-R Tax Forms, 6-Part, 10/Pack (STAX5R-23)

Item #: 901-24564852

Use Adams 1099-R to report distributions over $10 from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts and other sources to the IRS and recipients

For paper filers, the 2023 1099-R (copies B, C and 2) are due to your recipients by January 31, 2024; Copy A and 1096 are due to the IRS by February 28, 2024; or eFile by April 1, 2024; New IRS eFile regulations require e-Filing for 10 or more return

s of certain forms; Try the new Adams Tax Forms Helper to eFile to the IRS/SSA ...

s of certain forms; Try the new Adams Tax Forms Helper to eFile to the IRS/SSA ...

$33.69

Per pack

Adams 2023 1098 Mortgage Interest Statement Tax Forms with Self Seal Envelopes, 3-Part, 12/Pack (STAX1098-23)

Item #: 901-24564836

Use Form 1098 to report mortgage interest of $600 or more received during the year in the course of trade or business from an individual, including a sole proprietor

For paper filers, the 2023 1098 (copy B) is due to your recipients by January 31, 2024; mail Copy A and 1096 to the IRS by February 28, 2024; or eFile by April 1, 2024; New IRS eFile regulations require e-Filing for 10 or more returns of certain form

s; Try the new Adams Tax Forms Helper to eFile to the IRS/SSA ...

s; Try the new Adams Tax Forms Helper to eFile to the IRS/SSA ...

$30.59

Per pack

ComplyRight 2024 1095-C Tax Form, 1-Part, White/Black, 25/Pack (1095CIRS25)

Item #: 901-24507922

1095-C tax form

Single-part

For laser printers

$26.49

Per each

ComplyRight 2024 1095-C Tax Form, 1-Part, 500/Pack (1095C500)

Item #: 901-24507953

1095-C tax form

Single-part

Laser printer compatible

$76.59

Per each

ComplyRight 2024 1095-B Tax Form, 1-Part, White/Black, 500/Pack (1095BIRS500)

Item #: 901-24507903

1095-B tax form

Single-part

For laser printers

$71.49

1-2 each

Save 6%

$66.99

3+ each

ComplyRight 2024 1095-B Tax Form, 1-Part, White/Black, 500/Pack (1095B500)

Item #: 901-24507931

1095-B tax form

Single-part

For laser printers

$52.99

Per each

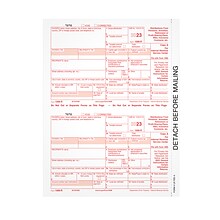

Adams 2023 1099-DIV Tax Forms, 5-Part, 10/Pack (STAX5DV-23)

Item #: 901-24564841

Use Form 1099-DIV to report gross dividends and other distributions; now a continuous-use form with a fill-in-the-year date field good for multiple tax years; the previously unnumbered FATCA box is now box 11 on the 1099-DIV and remaining boxes have

been renumbered ...

been renumbered ...

For paper filers, the 2023 1099-DIV (copy B) is due to your recipients by January 31, 2024; Copy A and 1096 are due to the IRS by February 28, 2024; or eFile by April 1, 2024; New IRS eFile regulations require e-Filing for 10 or more returns of certa ...

$30.59

Per pack

ComplyRight 2024 1099-K Tax Form, 1-Part, 2-Up, 100/Pack (5326)

Item #: 901-24582294

Form 1099-K for payments made in settlement of reportable payment transactions for each calendar year

2-up format: one sheet equals two forms

100 tax forms per pack

$27.99

Per each

ComplyRight 2024 1095-B Tax Form, 1-Part, White/Black, 50/Pack (1095BIRS50)

Item #: 901-24507906

1095-B tax form

Single-part

For laser printers

$24.99

Per each

ComplyRight 2024 1095-B Tax Form, 1-Part, White/Black, 50/Pack (1095B50)

Item #: 901-24507929

1095-B tax form used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage

Consists of two parts

For laser printers

$25.99

Per each

ComplyRight 2024 1095-B Tax Form, 1-Part, 2-Up, 500/Pack (1095BCBLK500)

Item #: 901-24578207

File the blank Form 1095-B and Form 1095-C with pressure seals and backer instructions according to the IRS guidelines

2-up format: one sheet equals two forms

500 tax forms per pack

$134.79

Per each

Adams 2024 1099-MISC Tax Form with e-files and Access to Adams Tax Forms Helper, 4-Part, 2-Up, Copy A, 1, B, 2, 24/Pack

Item #: 901-24596823

Use Form 1099-MISC to report miscellaneous income and payer-made sales of $5000 or more; the 1099-MISC is still a continuous use form with a fill-in-the-year date field good for multiple tax years

For paper filers, the 2024 1099-MISC Copy B is due to your recipients by Jan. 31, 2025 (if box 8 & 10 are empty) or Feb. 15 (if filled); Copy A & 1096 are due by Feb. 28; or eFile by Apr. 1, 2025; as of 2023, IRS eFile regulations require e-Filing fo

r 10 or more returns; Use Adams Tax Forms Helper to eFile to the IRS/SSA ...

r 10 or more returns; Use Adams Tax Forms Helper to eFile to the IRS/SSA ...

$49.99

Per pack

Featured

Adams 2024 1099-MISC Tax Form with e-files and Access to Adams Tax Forms Helper, 4-Part, 2-Up, Copy A, 1, B, 2, 50/Pack

Item #: 901-24596816

Use Form 1099-MISC to report miscellaneous income and payer-made sales of $5000 or more; the 1099-MISC is still a continuous use form with a fill-in-the-year date field good for multiple tax years

For paper filers, the 2024 1099-MISC Copy B is due to your recipients by Jan. 31, 2025 (if box 8 & 10 are empty) or Feb. 15 (if filled); Copy A & 1096 are due by Feb. 28; or eFile by Apr. 1, 2025; as of 2023, IRS eFile regulations require e-Filing fo

r 10 or more returns; Use Adams Tax Forms Helper to eFile to the IRS/SSA ...

r 10 or more returns; Use Adams Tax Forms Helper to eFile to the IRS/SSA ...

$52.09

Per pack

Adams 2024 1096 Summary Tax Form, 10/Pack (STAX1096-24)

Item #: 901-24596831

Use Form 1096 to submit the totals from information returns 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the IRS

A 1096 summary transmittal form must accompany each type of 1099 mailed to the IRS—due dates will vary by form; as of 2023, IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Try Adams Tax Forms Helper to eFile to the IRS

/SSA! ...

/SSA! ...

$16.29

Per pack

Adams 2024 1099-NEC Tax Form with Self-Seal Envelope, 4-Part, 3-Up, Copy A, 1, B, 2, 12/Pack (STAX512NEC-24)

Item #: 901-24596830

Use Form 1099-NEC to report non-employee compensation paid to independent contractors; the 1099-NEC is still a continuous-use form with a fill-in-the-year date field good for multiple tax years

The 2024 1099-NEC must be mailed or eFiled to the IRS and furnished to your recipients by January 31, 2025; As of 2023, IRS eFile regulations require e-Filing for 10 or more returns; Use the new Adams Tax Forms Helper to eFile to the IRS/SSA

4-Part 1099-NEC forms print 3 to a page on 4 micro-perforated sheets with copies A, 1, B & 2

$46.99

Per pack

Adams 2024 W-2 Tax Form with Self-Seal Envelopes and Access to Tax Forms Helper, 6-Part, 2-Up, Copy A, 1, B, C, 2, D, 12/Pack

Item #: 901-24596833

Use Form W-2 to report employee wages, tips and taxes withheld to the Social Security Administration and your employees

2024 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by January 31, 2025; As of 2023, IRS eFile regulations require e-Filing for 10 or more returns: Use Adams Tax Forms Helper to eFile to the IRS/SSA

6-Part W-2 forms print 2 to a page on 6 micro-perforated sheets with copies A, 1, B, C, 2 and D

$50.99

Per pack

Adams 2024 1099-DIV Tax Form with Access to Adams Tax Forms Helper, 4-Part, 2-Up, Copy A, 1, B, 2, 10/Pack (STAX5DV-24)

Item #: 901-24596818

Use Form 1099-DIV to report gross dividends and other distributions; the 1099-DIV is still a continuous-use form with a fill-in-the-year date field good for multiple tax years; the previously unnumbered FATCA box is now box 11 on the 1099-DIV and the

remaining boxes have been renumbered ...

remaining boxes have been renumbered ...

For paper filers, the 2024 1099-DIV (copy B) is due to your recipients by January 31, 2025; Copy A and 1096 are due to the IRS by February 28, 2025; or eFile by April 1, 2025; As of 2023, IRS eFile regulations require e-Filing for 10 or more returns; ...

$25.49

Per pack

Adams 2024 1099-R Tax Form with Access to Adams Tax Forms Helper, 5-Part, 2-Up, Copy A, 1, B, 2, 10/Pack (STAX5R-24)

Item #: 901-24596826

Use Adams 1099-R to report distributions over $10 from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts and other sources to the IRS and recipients

For paper filers, the 2024 1099-R (copies B, C and 2) are due to your recipients by January 31, 2025; Copy A and 1096 are due to the IRS by February 28, 2025; or eFile by April 1, 2025; New IRS eFile regulations require e-Filing for 10 or more return

s; Use Adams Tax Forms Helper to eFile to the IRS/SSA ...

s; Use Adams Tax Forms Helper to eFile to the IRS/SSA ...

$32.69

Per pack

TOPS 2024 1099 Tax Form, 1-Part, 2-Up, 100 Forms/Pack (LBLANKQ)

Item #: 901-5144

2024 1099 Tax Form 2 Up laser cut sheet with blank front and back with 1/2" right stub

Laser printer compatible

Printed in black ink

$22.49

Per pack

Adams 2024 W-2 1-Part Copy A Laser/Inkject Tax Forms, 100/pack (LW2FEDAW3)

Item #: 901-5201

2024 1-Part W-2 Copy A Forms for 100 employees and 6 W-3 forms

2024 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by January 31, 2025; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper to eFile to the IRS/SSA

1-Part W-2 Copy A sheets

$21.39

Per pack

TOPS 2023 1099-R Tax Form, 1-Part, Federal Copy A, 50/Pack (LRFEDA-S)

Item #: 901-920103

1099R Tax Forms for Distributions From Pensions, Annuities, etc. are used to report distributions from annuities, profit-sharing plans, retirement plans, IRAs, insurance contracts, or pensions.

1 part Federal Copy A laser cut sheet form

Laser/inkjet printer compatible

$18.39

1-3 pack

Save 7%

$16.99

4+ pack

Adams 2024 1099-INT Tax Form with Self-Seal Envelope, 4-Part, 2-Up, Copy A, 1, B, 2, 12/Pack

Item #: 901-24596825

Use Form 1099-INT to report interest income to the Internal Revenue Service and your recipients; the 1099-INT is still a continuous-use form with a fill-in-the-year date field good for multiple tax years

For paper filers, the 2024 1099-INT Copy B is due to your recipients by Jan. 31, 2025 (if box 8 & 10 are empty) or Feb. 15 (if filled); Copy A & 1096 are due by Feb. 28; or eFile by Apr. 1, 2025; as of 2023, IRS eFile regulations require e-Filing for

10 or more returns; Use Adams Tax Forms Helper to eFile to the IRS/SSA ...

10 or more returns; Use Adams Tax Forms Helper to eFile to the IRS/SSA ...

$24.49

Per pack

Adams 2024 W-2 Blank Laser/Inkject Tax Forms, 100/pack (BLW2Q)

Item #: 901-5207

2024 Blank W-2 Forms for up to 100 employees

2024 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by January 31, 2025; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper to eFile to the IRS/SSA

Blank W-2 forms with blank backers

$22.49

Per pack

Adams 2024 1099-NEC Tax Form with 10 e-files, 4-Part, 3-Up, Copy A, 1, B, 2, 50/Pack (STAX550NEC-24)

Item #: 901-24596828

Use Form 1099-NEC to report non-employee compensation paid to independent contractors; the 1099-NEC is still a continuous-use form with a fill-in-the-year date field good for multiple tax years

The 2024 1099-NEC must be mailed or eFiled to the IRS and furnished to your recipients by January 31, 2025; As of 2023, IRS eFile regulations require e-Filing for 10 or more returns; Use Adams Tax Forms Helper to eFile to the IRS/SSA

4-Part 1099-NEC forms print 3 to a page on 17 micro-perforated sheets with copies A, 1, B & 2

$57.19

Per pack