Page 3 of tax forms

(227 items found)

Sort by:

Best match

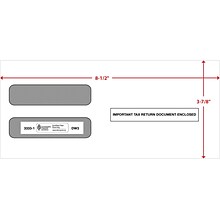

ComplyRight Self Seal Security Tinted Double-Window Tax Envelopes, 3 7/8" x 8 3/8", 50/Pack (DW19WS50)

Item #: 901-24507904

Double-window envelope for 3-Up 1099 tax form.

Self-sealing for added convenience.

Pack of 50 envelopes.

$37.79

Per each

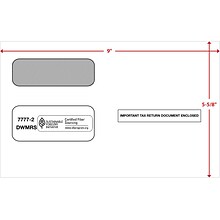

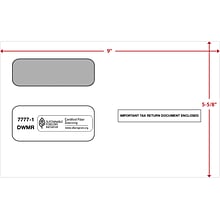

ComplyRight Moistenable Glue Security Tinted Double-Window Tax Envelopes, White, 50/Pack (7777150)

Item #: 901-24507932

Double-window envelope for 2-Up 1099 tax form.

Features a moisture/gum-seal flap.

Pack of 50 envelopes.

$41.89

Per each

ComplyRight Self Seal Security Tinted Double-Window Tax Envelopes, White, 25/Pack (7777225)

Item #: 901-24507916

Double-window envelope for 2-Up 1099 tax form.

Self-sealing for added convenience.

Pack of 25 envelopes.

$37.79

1-7 each

Save 25%

$27.99

8+ each

ComplyRight Moistenable Glue Security Tinted Double-Window Tax Envelopes, 3 7/8" x 8 3/8", 50/Pack (DW19W)

Item #: 901-24507972

Double-window envelope for 3-Up 1099 tax form.

Features a moisture/gum-seal flap.

Pack of 50 envelopes.

$37.79

Per each

ComplyRight Self Seal Security Tinted Double-Window Tax Envelopes, White, 50/Pack (3333250)

Item #: 901-24507957

Double-window envelope for W-2 (5210/5211) tax form.

Self-sealing for added convenience.

Pack of 50 envelopes.

$48.99

1-7 each

Save 28%

$34.99

8+ each

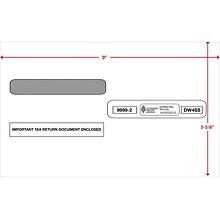

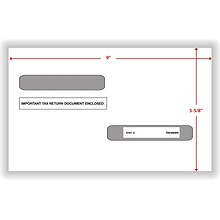

ComplyRight Self Seal Security Tinted Double-Window Tax Envelopes, 5 5/8" x 9", 50/Pack (9999250)

Item #: 901-24507968

Double-window envelopes for 4-Up W-2 (5205/5205A/5209) tax form.

Self-sealing for added convenience.

Pack of 50 envelopes.

$47.99

1-7 each

Save 8%

$43.99

8+ each

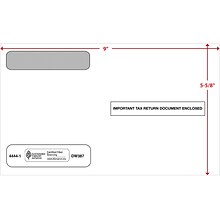

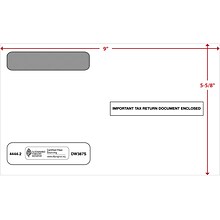

ComplyRight Moistenable Glue Security Tinted Double-Window Tax Envelopes, 5 5/8" x 9", 50/Pack (4444150)

Item #: 901-24507912

Double-window envelope for W-2 (5206/5208) tax form.

Features a moisture/gum-seal flap.

Pack of 50 envelopes.

$30.99

Per each

ComplyRight Moistenable Glue Security Tinted Double Window Tax Envelopes, 5 5/8" x 9", 50/Pack (1095CENV50)

Item #: 901-24507935

Double-window envelope for ACA 1095-C tax form.

Features a moisture/gum-seal flap.

Pack of 50 envelopes.

$43.89

1-9 each

Save 22%

$33.99

10+ each

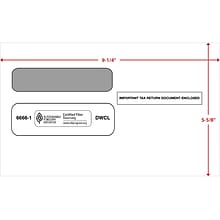

ComplyRight Moistenable Glue Security Tinted Double-Window Tax Envelopes, 5 5/8" x 9.25", 50/Pack (6666150)

Item #: 901-24507911

Double-window envelope for W-2 tax form.

Features a moisture/gum-seal flap.

Pack of 50 envelopes.

$31.59

1-3 each

Save 11%

$27.99

4+ each

ComplyRight Self Seal Security Tinted Double-Window Tax Envelopes, 5 5/8" x 9", 50/Pack (444250)

Item #: 901-24507915

Double-window envelope for W-2 (5206/5208) tax form.

Self-sealing for added convenience.

Pack of 50 envelopes.

$52.09

Per pack

ComplyRight Self Seal 1099-R Tax Double-Window Envelope, 5.63" x 9", White, 100/Pack (DW4MWS)

Item #: 901-24578233

Double-window envelope for the 4-up 1099-R tax form

Dimensions: 5.63" x 9"

Comes in white

$34.69

Per each

ComplyRight First Class Peel & Seal Tax Envelope, 9.5" x 12", White/Blue, 50/Pack (PEO41)

Item #: 901-24588702

Multipurpose tax return envelope quickly seals and protects data that will dress up every tax return and report from your office

Dimensions: 9.5" x 12"

Made of paper in white with blue accents

$41.89

Per each

ComplyRight First Class Moisture Seal Tax Envelope, 9.5" x 12", White/Blue, 50/Pack (PES45)

Item #: 901-24588693

Multipurpose tax return envelope quickly seals and protects data that will dress up every tax return and report from your office

Dimensions: 9.5" x 12"

Made of paper in white with blue accents

$35.69

Per each

ComplyRight Moistenable Glue Security Tinted Double-Window Tax Envelopes, 5 5/8" x 9", 100/Pack (99991100)

Item #: 901-24431087

Double-window envelope accommodates W-2 forms 5205, 5205A, and 5209.

Features a moisture/gum-seal flap.

Pack of 100 envelopes.

$65.29

Per each

ComplyRight Moistenable Glue Tax Envelope, 9.5" x 12", White/Blue, 50/Pack (PRK37)

Item #: 901-24588707

Double-window multipurpose tax return envelope will dress up every tax return and report from your office

Dimensions: 9.5" x 12"

Made of paper in white with blue accents

$35.69

Per each

ComplyRight Self Seal Security Tinted Double-Window Tax Envelopes, 5 5/8" x 9.25", 100/Pack (66662100)

Item #: 901-24431088

Double-window envelope accommodates W-2 forms.

Features a self-seal latex flap.

Pack of 100 envelopes.

$106.99

1-4 each

Save 23%

$81.99

5+ each

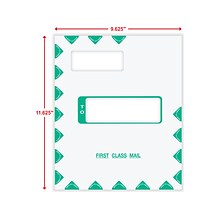

ComplyRight Self-Seal Tax Envelope, 11.63" x 9.63", White/Green, 50/Pack (PEV48)

Item #: 901-24588701

Double-window multipurpose tax return envelope will dress up every tax return and report from your office

Dimensions: 11.63" x 9.63"

Made of paper in white with green accents

$38.79

Per each

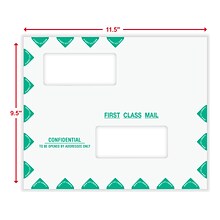

ComplyRight Self-Seal Tax Envelope, 9.5" x 11.5", White/Green, 50/Pack (PEV22)

Item #: 901-24588706

Double-window multipurpose tax return envelope will dress up every tax return and report from your office

Dimensions: 9.5" x 11.5"

Made of paper in white with green accents

$35.69

Per each

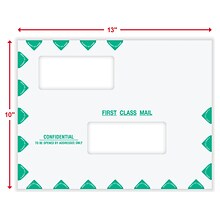

ComplyRight Self-Seal Tax Envelope, 10" x 13", White/Green, 50/Pack (PEB02)

Item #: 901-24588696

Double-window multipurpose tax return envelope will dress up every tax return and report from your office

Dimensions: 10" x 13"

Made of paper in white with green accents

$56.09

Per each

Medical Arts Press® Washington Laser Prescription Forms; Non Personalized

Item #: 901-26536

Security Features Include:

VOID pantograph, thermochromic ink, state seal in lower right-hand corner, microprint signature line and a watermark in opaque ink.

LUX W-2 / 1099 Envelopes (5 3/4 x 8) 50/Pack, White (7489-W2-50)

Item #: 901-23995716

Comes in White

Dimensions: 5.75"L x 8"W

Moistenable Glue Sealing Method

$46.99

Per pack

LUX W-2 / 1099 Envelopes (5 3/4 x 8) 500/Pack, White (7489-W2-500)

Item #: 901-23995918

Comes in White

Dimensions: 5.75"L x 8"W

Moistenable Glue Sealing Method

$159.99

Per pack

Adams Gummed W-2 Double Window Envelope, 3 7/8" x 8 1/4", White, 100/Pack (DW3ALT100)

Item #: 901-33331Q

W-2 Double Window Tax Envelopes are easy close, tinted for 100% security and are double-windowed to display both employer/payer and employee/recipient addresses

Use with LW23UPALT tax forms

24-lb. white wove stock

$69.39

1-5 pack

Save 7%

$63.99

6+ pack

Adams Self Seal Security Tinted Double Window Envelope, 3.75" x 8.5", White, 100/Pack (S1099-3PS)

Item #: 901-24496514

Simple, high-quality envelope for 1099-NEC tax forms

Dimensions: 3.75" x 8.5"

Made of white paper

$98.99

1-8 pack

Save 20%

$78.99

9+ pack