Page 8 of Tax Forms

(177 Products)About IRS tax forms

The IRS requires more than 100 tax forms and schedules, including W2 forms. Along with these documents come different envelopes for submitting tax forms to official IRS divisions or for enabling employers to mail tax form information to employees. The IRS requires many of these documents be printed with specific formats and ink, so the IRS accounting team can scan them. It is important that employers and filers use the official forms available from the IRS or from sanctioned printers.

Standard IRS forms for employers

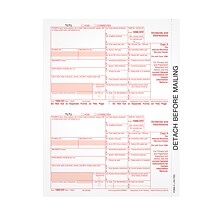

Employers send W2 forms to their employees each year, reporting the wages that employees earned and the federal taxes withheld. Employers must send copies of these employee-specific W2 forms to the Social Security Administration, indicating the total amount of wages paid and taxes withheld for all workers. Employers also complete 1099 forms for the non-wage payments they make to independent contractors or dividend payments to shareholders. Employers send a copy of these forms to individuals for tax return purposes.

Standard tax forms for individuals

Individual wage earners use form 1040 to file gross income returns. Individuals who received additional money or property on top of income and/or who claim tax credits or itemize deductions file the long form 1040. Individuals must attach copies of W2 forms they received from employers to their 1040 forms.

Other forms that filers submit

Individual 1040 filers who claim health expense deductions must verify those deductions. Filers have to submit health insurance claim forms along with the 1040s, and they rely on their providers to send them the proper documents. It’s critical that providers use official health insurance claim form envelopes to get the documents to their patients. These standard and folder-sized envelopes have single or double address windows with their contents clearly marked on the envelopes. Here are other forms people may have to submit:

- 1098 Mortgage Interest

- 1099 Dividends

- 1098T Tuition

- 1-9 Employee Eligibility Verification

Special features of W2 forms and 1099 forms

Some documents required by the IRS have to be in carbonless, multiple-copy format, with one page printed in red for IRS scanning purposes, and others in black for recipient records. Others have to be laser-print ready, so employers can easily print them out for multiple employees. Many envelopes, including W2 tax form envelopes, have to contain multiple address windows or 4-up printing capability for outputting multiple images, including addresses and postage metering.