Shop Forms

(403 items found)

Sort by:

Best match

Medical Arts Press® Dental Consent Form; Rainbow FormFamily™, Dental

Item #: 901-10039

100 sheets per package

Size: 8-1/2" x 11"

Form Printed on 1 Side

$26.49

Per pack

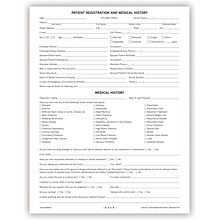

Medical Arts Press® Chiropractic Registration and History Form without Updates, Sky Blue, 250 Forms/Pack (20572)

Item #: 901-20572

Forms ensure reimbursement, improve risk management and document your clinical process

Comprehensive color forms include areas for complete registration and history information, reason for visit, type of pain, site of pain or numbness

Also features areas for severity, onset, effect on daily activities, and co

$63.29

1 pack

Save 5%

$59.99

2+ pack

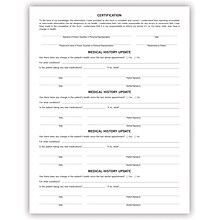

Medical Arts Press® Dental Registration Forms Featuring Updates Section, Unpunched, Sky Blue

Item #: 901-20558NP

Type of form: Dental registration form

250 per pack

Size: 8 1/2" x 11"

$58.19

Per pack

$20.59

Per pack

Medical Arts Press FormFamily Periodontal Exam Form (20607)

Item #: 901-20607

Type of form: Periodontal exam form

250 per pack

Size: 8 1/2" x 11"

$54.09

1 pack

Save 5%

$50.99

2+ pack

Medical Arts Press FormFamily Dental History Update Form (20610)

Item #: 901-20610

Type of form: Dental history update form

250 per pack

Size: 8 1/2" x 11"

$41.89

Per pack

Medical Arts Press® FormFamily Dental Exam Form

Item #: 901-20609

Form size: 8-1/2x11"

2-hole punched on top

5-hole punched on the left side

$48.99

Per pack

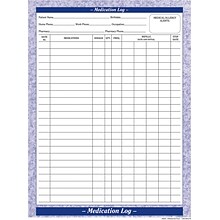

Medical Arts Press® Medications Form, Purple FormFamily™

Item #: 901-20645

Comprehensive form helps you monitor medication dosages, quantity, frequency, and refills

Printed in blue ink on white 24-lb. bond paper

Predrilled holes on top or side of form

$23.09

1 pack

Save 15%

$19.59

2+ pack

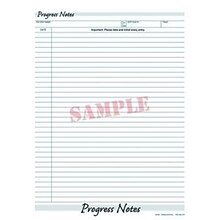

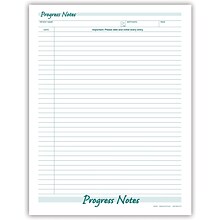

Medical Arts Press® Progress Notes Patient Care Form; Green FormFamily™

Item #: 901-20381

Records detailed chronological notes of ongoing patient care for illnesses, treatments and progress

Helps you conform to NCQA & JCAHO guidelines

2-hole punched at top, 5-hole punched on left side

$45.89

1 pack

Save 8%

$41.99

2+ pack

Medical Arts Press Replacement Day Sheet Forms; Bond, Format S1 (WJM11)

Item #: 901-20527

Replacement day sheet forms

Number of parts: One

50/Pack

$43.89

2+ pack

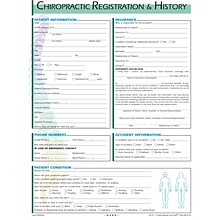

Medical Arts Press® Chiropractic Registration and History Form

Item #: 901-21701

Forms ensure reimbursement, improve risk management and document your clinical process

Comprehensive color forms include areas for complete registration and history information, reason for visit, type of pain, site of pain or numbness

Also features areas for severity, onset, effect on daily activities, and co

$65.29

Per pack

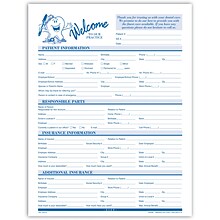

Medical Arts Press® Dental Registration and History Form without Updates, Tooth Character

Item #: 901-20588

Type of form: Registration and history form

250 per pack

Size: 8 1/2" x 11"

$64.29

Per pack

Featured

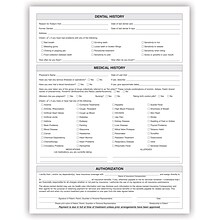

Medical Arts Press® Dental Registration and History Form, English

Item #: 901-20129NP

Type of form: Dental registration and history form

250 per pack

Size: 8 1/2" x 11"

$56.09

Per pack

Medical Arts Press® Podiatry Registration and History Form, Teal, No Punch

Item #: 901-20590NP

Type of form: Registration and history form

250 per pack

Size: 8 1/2" x 11"

$52.09

1 pack

Save 5%

$48.99

2+ pack

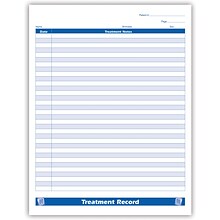

Medical Arts Press® Dental Treatment Record Form; 2-Sided

Item #: 901-20608

Ideal for practices that prefer not to record fees on their treatment notes

Form includes basic patient information

Two-sided with back of form ruled

$53.09

Per pack

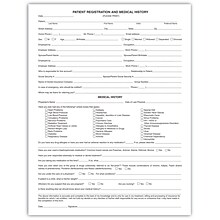

Medical Arts Press Dental Registration and Medical History Form, Spanish (20586)

Item #: 901-20586

Type of form: Dental registration and medical history form

250 per pack

Size: 8 1/2" x 11"

$24.99

1 pack

Save 4%

$23.99

2+ pack

Medical Arts Press Dental Registration and Medical History Form, Ledger Stock, 250/Pack (20128RL)

Item #: 901-20128MAP

Type of form: Dental registration and medical history form

250 per pack

Size: 8 1/2" x 11"

$55.09

Per pack

Medical Arts Press Dental Registration and History Form, 250/Pack (20605)

Item #: 901-20605

Form allows you to gather complete information from patients

Simple to fill out with individually numbered sections

Includes sections on patient information, insurance, history and more

$50.99

Per pack

Medical Arts Press® Chiropractic Registration and History Forms, Holistic Care

Item #: 901-15165

Forms ensure reimbursement, improve risk management and document your clinical process

Comprehensive color forms include areas for complete registration and history information, reason for visit, type of pain, site of pain or numbness, severity

Also includes areas for onset, effect on daily activities, and conditions

$82.69

Per pack

Medical Arts Press® Registration Forms without Updates Section ; Brush Silhouette

Item #: 901-21786

Comprehensive form gathers complete insurance information, making it easier for you to process claims

Silhouetted toothbrush design welcomes patients

Printed in 1-color on two sides on 24-lb. white bond paper

$54.09

Per pack

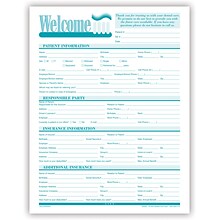

Medical Arts Press® Dental Registration and History Form, Welcome, Toothbrush, Teal Design, No Punch

Item #: 901-20582NP

Type of form: Registration and history form

250 per pack

Size: 8 1/2" x 11"

$53.09

Per pack

Medical Arts Press® Registration Form; Smile Team™

Item #: 901-21784

Comprehensive form gathers complete insurance information, making it easier for you to process claims

Friendly "happy teeth" design welcomes patients

Printed in 2-color on two sides on 24-lb. white bond paper

$69.39

1 pack

Save 6%

$64.99

2+ pack

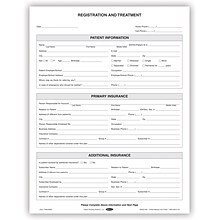

Medical Arts Press® Dental Registration and Treatment Form, 4-Pages

Item #: 901-20551

Type of form: Registration and treatment form

250 per pack

Size: 8 1/2" x 11"

$73.49

1-3 pack

Save 6%

$68.99

4+ pack

Medical Arts Press Welcome Registration Form, Eye Graphic

Item #: 901-21783

Type of form: Message sign

Size: 8" x 5"

Message type: Standard

$73.49

1 pack

Save 6%

$68.99

2+ pack