Page 2 of W 2 Tax Forms for Laser Printers 4 Part Carbonless 50 Loose

(281 items found)

Sort by:

Best match

TOPS 2023 1099-NEC Tax Form Kit with Software & Envelopes, 5-Part, 100/Pack (LNEC5WSKIT-S)

Item #: 901-24450259

Form 1099-NEC records all nonemployee compensation to the IRS and recipients, replacing Box 7 on the 1099-MISC

Five-part tax forms

Tax forms are inkjet and laser printer compatible

$89.99

Per pack

Adams 2023 1098 Mortgage Interest Statement Tax Forms with Self Seal Envelopes, 3-Part, 12/Pack (STAX1098-23)

Item #: 901-24564836

Use Form 1098 to report mortgage interest of $600 or more received during the year in the course of trade or business from an individual, including a sole proprietor

For paper filers, the 2023 1098 (copy B) is due to your recipients by January 31, 2024; mail Copy A and 1096 to the IRS by February 28, 2024; or eFile by April 1, 2024; New IRS eFile regulations require e-Filing for 10 or more returns of certain form

s; Try the new Adams Tax Forms Helper to eFile to the IRS/SSA ...

s; Try the new Adams Tax Forms Helper to eFile to the IRS/SSA ...

$23.59

Per pack

TOPS 2023 1099-NEC Tax Form, Copy C, 150/Pack (LNECPAY2)

Item #: 901-LNECPAY2

Form 1099-NEC records all nonemployee compensation to the IRS and recipients, replacing Box 7 on the 1099-MISC

The 2023 1099-NEC must be mailed or e-filed to the IRS and furnished to your recipients by February 1, 2023

Copy C/2 Payer and State sheets are printed 3 to a page on 50 micro perforated sheets

$14.59

Per pack

TOPS 2023 1099 Tax Form, 1-Part, 2-Up, 100/Pack (LBLANKQ)

Item #: 901-5144

1099 Tax Form 2 Up laser cut sheet with blank front and back with 1/2" right stub

Use with 1099 Tax Forms

Laser printer compatible

$14.59

1-5 pack

Save 4%

$13.99

6+ pack

TOPS 2023 1098 Tax Form, Federal Copy A, 50/Pack (L1098FED-S)

Item #: 901-920020

1098 Mortgage Interest Tax Forms detail the amount of interest and mortgage-related expenses paid on a mortgage during the tax year

Federal Copy A laser cut sheet form

Laser/inkjet printer compatible

$7.49

1-3 pack

Save 6%

$6.99

4+ pack

Adams 2022 1099-NEC Tax Form, 5-Part, 50/Pack (STAX550NEC-22)

Item #: 901-24530916

Use the form 1099-NEC to report nonemployee compensation paid to independent contractors

Must be mailed or e-Filed to the IRS and furnished to your recipients by January 31, 2023

Five-part 1099-NEC forms print three to a page on 17 microperforated sheets with Copies A, C/1, B, 2, and C/1

$40.99

Per pack

Adams 2023 1099-DIV Tax Forms, 5-Part, 10/Pack (STAX5DV-23)

Item #: 901-24564841

Use Form 1099-DIV to report gross dividends and other distributions; now a continuous-use form with a fill-in-the-year date field good for multiple tax years; the previously unnumbered FATCA box is now box 11 on the 1099-DIV and remaining boxes have

been renumbered ...

been renumbered ...

For paper filers, the 2023 1099-DIV (copy B) is due to your recipients by January 31, 2024; Copy A and 1096 are due to the IRS by February 28, 2024; or eFile by April 1, 2024; New IRS eFile regulations require e-Filing for 10 or more returns of certa ...

$21.79

Per pack

Adams 2022 1099-NEC Tax Form, 5-Part, 24/Pack (STAX5241NEC-22)

Item #: 901-24530920

Use the form 1099-NEC to report nonemployee compensation paid to independent contractors

Must be mailed or e-Filed to the IRS and furnished to your recipients by January 31, 2023

Five-part 1099-NEC forms print three to a page on eight microperforated sheets with Copies A, C/1, B, 2, and C/1

$42.99

Per pack

Adams 2023 1099-MISC Tax Forms Kit with Adams Tax Forms Helper and 5 Free eFiles, 24/Pack (STAX5241MISC-23)

Item #: 901-24564844

Use Form 1099-MISC to report miscellaneous income and payer-made sales of $5000 or more; now a continuous use form with a fill-in-the-year date field good for multiple tax years; the previously unnumbered FATCA box is now box 13 on the 1099-MISC and

remaining boxes have been renumbered ...

remaining boxes have been renumbered ...

For paper filers, the 2023 1099-MISC Copy B is due to your recipients by Jan. 31, 2024 (if box 8 & 10 are empty) or Feb. 15 (if filled); Copy A & 1096 are due by Feb. 28; or eFile by Apr. 1, 2024; New IRS eFile regulations require e-Filing for 10 or ...

$46.99

Per pack

Adams 2023 1099-NEC Tax Forms Kit with Self Seal Envelopes and Adams Tax Forms Helper, 12/Pack (STAX512NEC-23)

Item #: 901-24564854

Use Form 1099-NEC to report non-employee compensation paid to independent contractors; now a continuous-use form with a fill-in-the-year date field good for multiple tax years

The 2023 1099-NEC must be mailed or eFiled to the IRS and furnished to your recipients by January 31, 2024; New IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use the new Adams Tax Forms Helper to eFile to the IRS/SSA

5-Part 1099-NEC forms print 3 to a page on 4 micro perforated sheets with copies A, C/1, B, 2 & C/1

$30.99

Per pack

Adams 2023 W2 Tax Forms Kit with Adams Tax Forms Helper and 10 Free eFiles, 50/Pack (STAX650W-23)

Item #: 901-24564835

Use Form W-2 to report employee wages, tips and taxes withheld to the Social Security Administration and your employees

2023 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by January 31, 2024; New IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use the new Adams Tax Forms Helper to eFile to the IRS/SSA

6-Part W-2 forms print 2 to a page on 25 micro perforated sheets with copies A, D/1, B, C, 2 and D/1

$50.99

Per pack

Adams 2023 1099-NEC Tax Forms Kit with Adams Tax Forms Helper and 10 Free eFiles, 50/Pack (STAX550NEC-23)

Item #: 901-24564837

Use Form 1099-NEC to report non-employee compensation paid to independent contractors; now a continuous-use form with a fill-in-the-year date field good for multiple tax years

The 2023 1099-NEC must be mailed or eFiled to the IRS and furnished to your recipients by January 31, 2024; New IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use the new Adams Tax Forms Helper to eFile to the IRS/SSA

5-Part 1099-NEC forms print 3 to a page on 17 micro perforated sheets with copies A, C/1, B, 2 & C/1

$37.99

Per pack

Adams 2023 1099-NEC Tax Forms Kit with Adams Tax Forms Helper and 5 Free eFiles, 24/Pack (STAX5241NEC-23)

Item #: 901-24564842

Use Form 1099-NEC to report non-employee compensation paid to independent contractors; now a continuous-use form with a fill-in-the-year date field good for multiple tax years

The 2023 1099-NEC must be mailed or eFiled to the IRS and furnished to your recipients by January 31, 2024; New IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use the new Adams Tax Forms Helper to eFile to the IRS/SSA

5-Part 1099-NEC forms print 3 to a page on 8 micro perforated sheets with copies A, C/1, B, 2 & C/1

$30.99

Per pack

TOPS Self Seal Security Tinted Double Window W-2 Tax Form Envelope, White, 100/Pack (DW4ALTPS100)

Item #: 901-24496518

Simple, high-quality double-window envelope for W-2 tax forms (four-up forms per sheet in four-corner style)

Dimensions: 5 5/8" x 9"

Made of white paper

$33.99

1-5 pack

Save 5%

$31.99

6+ pack

Adams 2023 1099-INT Tax Forms with Self Seal Envelopes, 5-Part, 12/Pack (STAX5INT-23)

Item #: 901-24564834

Use Form 1099-INT to report interest income to the Internal Revenue Service and your recipients; now a continuous-use form with a fill-in-the-year date field good for multiple tax years

For paper filers, the 2023 1099-INT (copy B) is due to your recipients by January 31, 2023; mail Copy A and 1096 to the IRS by February 28, 2024; or eFile by April 1, 2024; New IRS eFile regulations require e-Filing for 10 or more returns of certain

forms; Try the new Adams Tax Forms Helper to eFile to the IRS/SSA ...

forms; Try the new Adams Tax Forms Helper to eFile to the IRS/SSA ...

$23.99

Per pack

TOPS 2023 1099-R Tax Form, 1-Part, Federal Copy A, 50/Pack (LRFEDA-S)

Item #: 901-920103

1099R Tax Forms for Distributions From Pensions, Annuities, etc. are used to report distributions from annuities, profit-sharing plans, retirement plans, IRAs, insurance contracts, or pensions.

1 part Federal Copy A laser cut sheet form

Laser/inkjet printer compatible

$8.59

1-3 pack

Save 6%

$7.99

4+ pack

TOPS 2023 1099-DIV Tax Form, 1-Part, Federal Copy A, 100/Pack (LDIVFED16)

Item #: 901-5130

1099DIV Tax Forms used to report gross dividends and other distributions on stock, investment expenses, capital gain dividends, non-taxable distributions and liquidation distribution

1 part Copy A laser cut sheet form

Laser printer compatible

$14.99

1-3 pack

Save 6%

$13.99

4+ pack

TOPS 2023 1099 Tax Form, 1-Part, 100/Pack (LB1099NB34)

Item #: 901-5174

1099 Tax Form laser cut sheet with blank front and back with 1/2" right stub

Use with 1099 Tax Forms

Laser printer compatible

$12.99

1-8 pack

Save 3%

$12.59

9+ pack

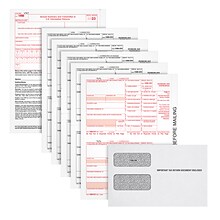

Adams 2023 1099-R Tax Forms, 6-Part, 10/Pack (STAX5R-23)

Item #: 901-24564852

Use Adams 1099-R to report distributions over $10 from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts and other sources to the IRS and recipients

For paper filers, the 2023 1099-R (copies B, C and 2) are due to your recipients by January 31, 2024; Copy A and 1096 are due to the IRS by February 28, 2024; or eFile by April 1, 2024; New IRS eFile regulations require e-Filing for 10 or more return

s of certain forms; Try the new Adams Tax Forms Helper to eFile to the IRS/SSA ...

s of certain forms; Try the new Adams Tax Forms Helper to eFile to the IRS/SSA ...

$22.79

Per pack

TOPS 2023 1099-INT Tax Form, 5-Part, 100/Pack (LINT4KIT-S)

Item #: 901-920062

1099INT Interest Income Tax Forms are used to report interest income to the Internal Revenue Service.

5-part kit includes copies A, B, C, 2, and C, 1096 forms, and double window envelopes

Laser/inkjet printer compatible

$66.99

Per pack

TOPS 2023 1099-INT Tax Form, Federal Copy A, 50/Pack (LINTFED-S)

Item #: 901-920063

1099-INT Interest Income Tax Forms are used to report interest income to the Internal Revenue Service.

Federal Copy A laser cut sheet form

Laser/inkjet printer compatible

$11.99

1-3 pack

Save 3%

$11.59

4+ pack

TOPS 2023 1099-DIV Tax Form, 5-Part, 100/Pack (LDIV4KIT-S)

Item #: 901-920055

1099DIV Dividends & Distributions Tax Forms are used to report gross dividends and other distributions on stock, investment expenses, capital gain dividends, non-taxable distributions and liquidation distribution

5-part kit includes copies A, B, C, 2, and C, 1096 forms, and double window envelopes

Laser/inkjet printer compatible

$69.99

1-3 pack

Save 4%

$66.99

4+ pack

Adams 2023 1099-MISC eFile Tax Forms Kit, w/ Self Seal Envelopes, Access to new Adams Tax Forms Helper, 12/Pack (STAX512MISC-23)

Item #: 901-24564840

Use Form 1099-MISC to report miscellaneous income and payer-made sales of $5000 or more; now a continuous-use form with a fill-in-the-year date field good for multiple tax years; the previously unnumbered FATCA box is now box 13 on the 1099-MISC and

remaining boxes have been renumbered ...

remaining boxes have been renumbered ...

For paper filers, the 2023 1099-MISC Copy B is due to your recipients by Jan. 31, 2024 (if box 8 & 10 are empty) or Feb. 15 (if filled); Copy A & 1096 are due by Feb. 28; or eFile by Apr. 1, 2024; New IRS eFile regulations require e-Filing for 10 or ...

$28.99

Per pack

Adams 2023 W2 2 Tax Forms Kit with Adams Tax Forms Helper and 5 Free eFiles, 24/Pack (STAX6241-23)

Item #: 901-24564851

Use Form W-2 to report employee wages, tips and taxes withheld to the Social Security Administration and your employees

2023 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by January 31, 2024; New IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use the new Adams Tax Forms Helper to eFile to the IRS/SSA

6-Part W-2 forms print 2 to a page on 12 micro perforated sheets with copies A, D/1, B, C, 2 and D/1

$49.99

1-3 pack

Save 4%

$47.99

4+ pack