Last October, the national health insurance exchanges were launched. There has been quite a bit of press each day since about the pros and cons of the new health insurance exchanges, the previous problems with the federally run website, “grandfathered” individual insurance policies that are being cancelled because these policies did not meet the minimum coverage requirements established in the Affordable Care Act and the cost of premiums for those who enroll but do not qualify for federal subsidies.

However, there is very little written about the effects of Health Insurance Exchanges on medical practices and how to navigate the health insurances exchanges to maximize reimbursements. The purpose of this article is to help medical practices learn about ways to better manage health insurance exchange patient reimbursements.

First, it is important to have a basic understanding of the structure of the health exchanges. That is, what is consistent across all exchanges (federally run and state run) and what is unique and, therefore, inconsistent. As of the time of this writing, there were 16 states that have implemented state run exchanges. The remaining 36 exchanges (including Washington D.C.) are either run by the federal government or in a partnership with the federal government. See figure 1, below:

Regardless of who runs the exchanges, the state or the federal government, there are some very clear consistencies. Here are the key elements of the state exchanges that are consistent. There are other common elements, but the following are key operational elements which have downstream effects on the delivery and reimbursement for care. We have highlighted the items that are key to understanding the exchange plans from a provider perspective. Key features that are common across all exchanges and all plans are:

- Each state offers the exact same plans, both in features and structure. There are catastrophic, bronze, silver, gold and platinum plans offered in each state exchange.

- Each of these plans, regardless of the payers who participate, have the same percentage of payer coverage. Catastrophic will provide for 60% coverage, Bronze <60%, Silver 70%, Gold 80% and Platinum 90%.

- Each plan requires that doctor visits, prescription drugs, hospitalization, maternity and newborn care, and preventative care be a part of the exchange plan.

However, there are many inconsistencies at this time. Inconsistencies include:

- Which payers choose to participate in a particular state exchange

- The premiums established by each payer

- The benefit plans (Catastrophic through Platinum) that the payers choose to offer

- The products established for the exchange plans

- The physician reimbursement associated with exchange plans

As of this writing in August, 2014, many of the enrollment difficulties at the federal website have been resolved. However, it is estimated that 5 million (or more) people purportedly had their current insurance policies terminated effective 1/1/2014. The resolution of this issue could affect the physician reimbursement outcomes as those individuals look for new plans on the exchanges, possibly at lower reimbursement rates, in some cases, than standard PPO Plans. The current trend in healthcare exchange enrollment indicates that the vast majority of individuals currently enrolled in state exchange plans qualify for expanded Medicaid coverage, and are accessing policies with reimbursement rates equal or close to state Medicaid rates. This could potentially have a significant downside impact on a practice’s revenue and margins.

There are a range of questions about the exchanges as it relates to physician reimbursements, and here we will take a pragmatic view of each.

Here are some of the common questions that physicians are asking:

- How do I know if I have an option to contract with a payer’s exchange product or opt out of an exchange product?

- How can I validate if my practice is already in an exchange product?

- What are my exchange product reimbursement rates and do they differ from my current contracted rates?

- With enrollment problems, why would we assume that there will be accurate systems and business processes in place to track premium payments for exchange-based policies/plans, benefit eligibility and deductible amounts paid to date?

- Can I collect from the insurance company if a patient in an exchange plan misses premium payment(s) or has terminated or changed their plan choice in the exchange?

How do you know if you have an option to contract with a payer’s exchange product and how do I validate participation?

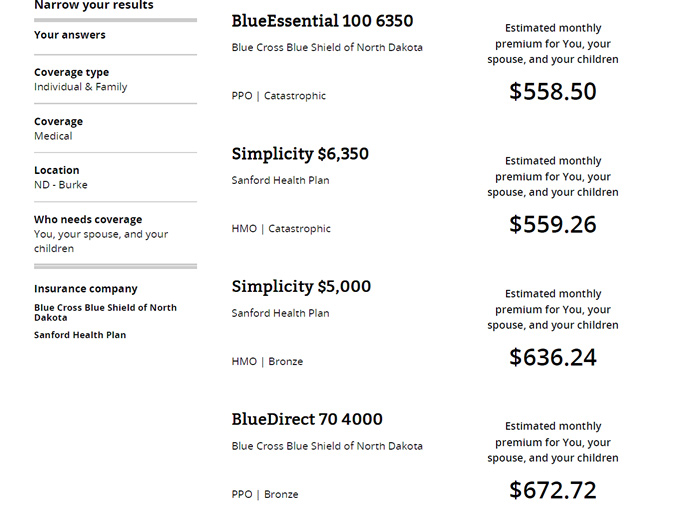

The answer varies from payer to payer and from state to state. First, whether you participate in a state run exchange or a federally run state exchange, you can go to healthcare.gov and figure out the plans that are in place in your state. Simply go to the healthcare.gov web site and follow the questions about coverage for a family to get to the options available. If you are in a state run exchange, this site is now integrated to your state’s website and will transition you during your answers to the qualifying questions. Below is a partial result of navigating healthcare.gov for a selected county in the state of North Dakota to find plans for a family including, “You, your spouse and children”. You immediately get the results for all payers and plans that are a part of the exchange, along with the estimated premium payments based on the query:

Next, now that you have identified the plans, you can now go to the website of the payer that offers the plan(s) to determine whether or not a physician or practice is a participating provider in the plan. In the example above, you would go to Blue Cross Blue Shield of North Dakota’s website, and search for a physician or practice by name.

If you determine that your practice is in a payer’s network, the next question is “What will my reimbursement be for this exchange product”? Often, the reimbursement for exchange products is the same as your current contracted fee schedule for the plan product in which the patient is enrolled. The difference, operationally, is that exchange products have patient co-payments that vary based on the beneficiaries’ selected exchange product. For example, a patient who has a PPO catastrophic plan may have a >40% co-payment while a patient who has a Platinum plan in the same exchange product may have only a 10% co-payment. This means that your office staff will need to have both the business processes and systems in place to track the variance of co-payments required from patients based upon the patients’ selected plans. This will place a requirement on your office staff to track the details for each patient and to make sure that the appropriate co-payment is collected from the patient and that the payer pays its portion of the contracted rate. Since the exchange plan co-payments, deductibles and co-insurance requirements will vary based on the exchange plan type, it is imperative that the office team put the appropriate systems in place to insure that patient payments are accurately collected.

Since payers that participate in the plans need broad physician networks in support of the exchange plans, if you are a specialist, you may be able to use an agreement to participate in an existing or new exchange plan product as leverage in a contract negotiation or re-negotiation of an existing payer agreement. Generally you have the options to “opt in” or “opt out” of a state exchange plan product. In some cases, for example, a large payer in Arizona automatically pays contracted practices the same contracted rates as its standard PPO plans. However, it is still incumbent that practices who are “auto enrolled” in the exchange plans, at the usual PPO rates, to verify benefits and collect co-payments, deductibles, and co-insurance payments according to the terms of the state based plan since these payments vary for all plans from catastrophic to platinum.

Some states have new payer products being put in place with new and, in some cases, lower fees for service reimbursements from the usual commercial products offered in the individual or small business markets both in and outside of the exchanges. Anecdotally, we have seen one such scenario in the state of Texas, for example. In this case, in order to complete a renegotiation of an existing agreement, a payer required, in exchange for an increase on an existing PPO fee schedule, that a practice participate in a new exchange plan, which paid significantly less than the PPO plan being negotiated and was to be offered both inside and outside the exchange in the coming year. In this case, it is imperative that you determine the financial effect of choosing to participate in the new product by understanding the estimated population of people who may choose this new plan both on and off of the exchange. It is important to ask questions, such as, “How and to whom is this new plan going to be marketed - to individuals and employer groups?” “Will this new plan be incentivized at brokerage firms?” Once properly armed with information, you may have an opportunity to leverage your agreement to participate in the new product to help achieve increases in your exiting agreement.

To protect against unexpected and undesirable outcomes, such as discovering that you are unknowingly participating in an exchange plan at low reimbursement rates, it is best to take a methodical approach to determine your status as it relates to each of your payer contracts and the plans covered by each contract. The best practice would be to first catalog all of your key commercial payer contracts. That is, create a list of the payers and the plans/products in which you are contracted. Then, as described above, go to the website in your state to determine the payers who are offering plans on your state exchange, by payer, and then by product. Next determine if you are already listed as a participant in those plans by reviewing your contract documents or researching on each payer’s website which plans are shown as being accepted by your practice. Last, validate the fee schedule that is in place when you service exchange based patients. Also, be aware that many payers have sent or will be sending written correspondence to communicate their procedures for your exchange participation. Read all payer correspondence carefully and respond appropriately. In some cases, a non-response could mean that you or your practice is automatically enrolled in a plan or automatically opted out. In other cases, you have to respond before the noted deadline in order to opt in or opt out.

With enrollment problems, why would we assume that there will be accurate systems and business processes in place to track premium payments for exchange-based policies/plans, benefit eligibility and deductible amounts paid to date?

It is critical that your billing and practice management systems be plumbed to handle the business rules related to exchange patients such as the 90-day grace period and to insure that each individual claim is tracked and paid per your contracted rate. While the payers and the exchanges have their systems, it is best that you rely on your own systems to insure timely payments and accuracy of payments.

Can I collect from the insurance company if a patient in an exchange plan misses premium payment(s) or has terminated or changed their plan choice in the exchange?

One of the potential “gotchas” of administering patients who are in exchange plans is the 90-day grace period rule. That is, patients who are in exchange plans and receiving subsidies are given 90-days to catch up on their premiums once they miss a payment. The grace period is triggered once a patient with subsidized exchange plan coverage misses a premium payment. Instead of immediately terminating the patient’s policy, health plans must give the patient 90 days to catch up. Federal rules allow health plans to pay, hold, deny, or later recoup payment of claims for services incurred in the second or third month of that window if patients are delinquent on their premium payments. However, insurers must pay physicians for services provided to a patient in the first 30 days of the grace period, and insurers still must comply with state law requiring prompt payment of claims submitted at any point during the grace period. For patients who are not subsidized, the termination policy, including grace periods and payer/provider responsibilities, reverts to the laws and regulations in the state in which the patient purchased their exchange-based plan. The issue, therefore, is a practice management matter. That is, it will be incumbent on practices to verify, prior to delivering services (each time) that patients’ with exchange based plans are current on their premium payments, and not in a grace period due to non-payment. Additionally, it would be prudent to verify that previous claims have been paid in a timely manner. If not, there is the potential of having to collect the full amount of reimbursement (both payer and patient responsibility portions) directly from the patients, increasing the risk of larger amounts of outstanding accounts receivable and lost revenue due to inability to collect after services are rendered.

In summary, there are many considerations for a practice when looking at participation in a new or existing product offered by a payer on the health insurance exchange. There are key business and systems processes that need to be in place to detect the current status of participation and to determine the reimbursement rates of an exchange-based plan. It is important that you have a clear plan in place now to navigate the exchanges. In addition to the advice in this article, it is imperative, too, that you consult your legal counsel about the legal ramifications for provider participation and business practices relating to health exchanges.

Steve Selbst, CEO, Healthcents Inc. and co-authored by Susan Charkin, President, Healthcents Inc. and Regina Vasquez, Senior VP, Healthcents Inc.

Steve can be reached at www.healthcents.com/steve or 831-455-2174 or selbst@healthcents.com. Healthcents is the nationwide leader in enabling medical practices to maximize their commercial payer contracts’ reimbursements.